dpst etf stock price

Quick Ratio-Sales past 5Y-Gross Margin-52W Low. Leveraged power rankings are rankings between US-listed leveraged ETFs on certain investment-related metrics including 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields.

Already Up 35 In 2021 The Dpst Etf Isn T Messing Around

ETF issuers are ranked based on their aggregate 3-month fund flows of their ETFs with exposure to Regional Banks.

. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of different ETF issuers with ETFs that have exposure to Regional Banks. Cashsh-PC-EPS next 5Y-ROE-52W Range. PFCF-EPS past 5Y-ROI-52W High-2008.

All values are in US.

Regional Banks Bull Bear 3x Etfs Seeks Daily Investment Results Of 300 Of The Performance Of The Solactive Us Regional Banks To Data Quotes Region Investing

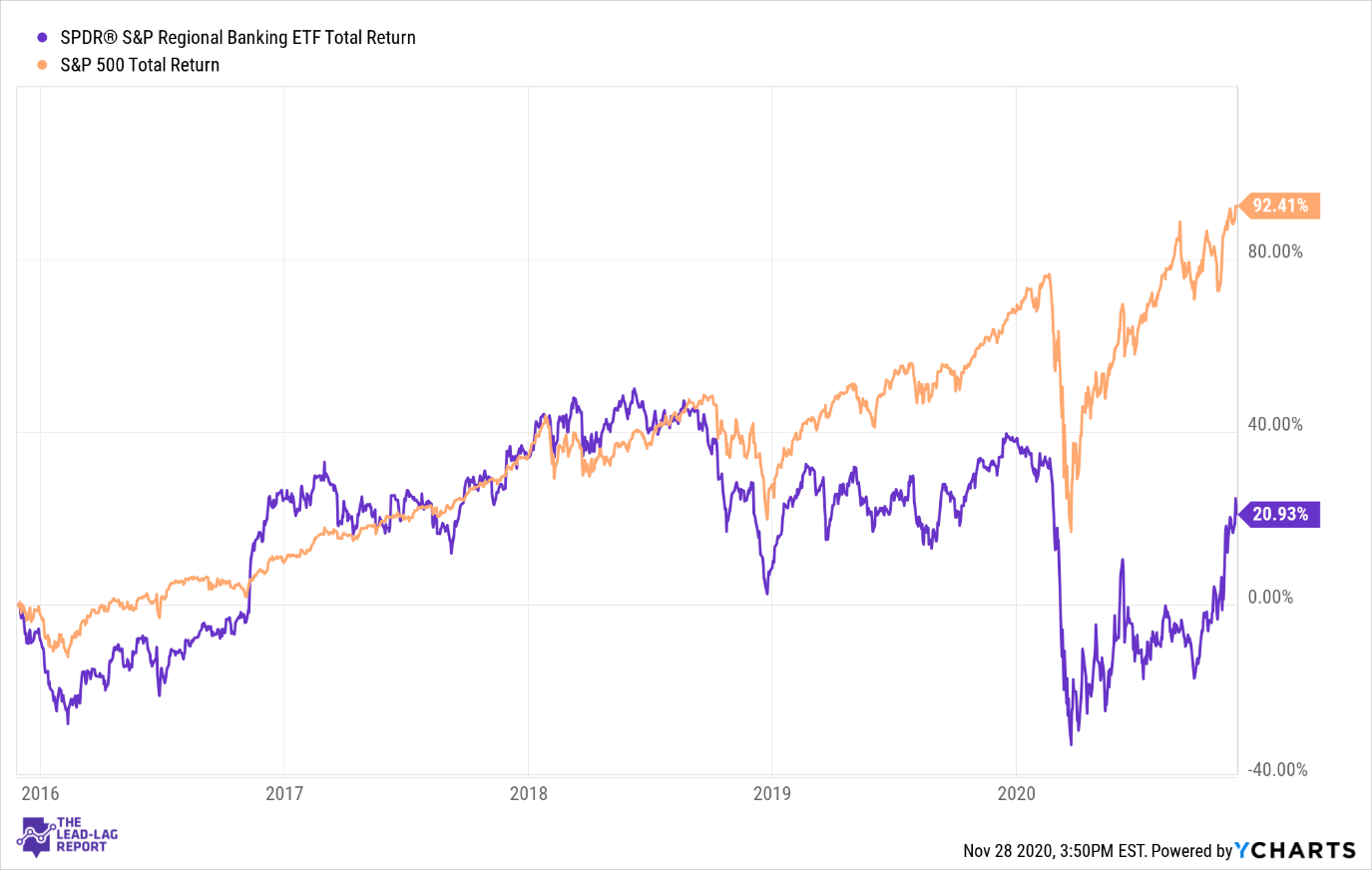

Here S How To Play Range Bound Regional Banking Etfs

Here S How To Play Range Bound Regional Banking Etfs

This Regional Banks Etf Is Up 35 Over The Past Year Newetfs Io

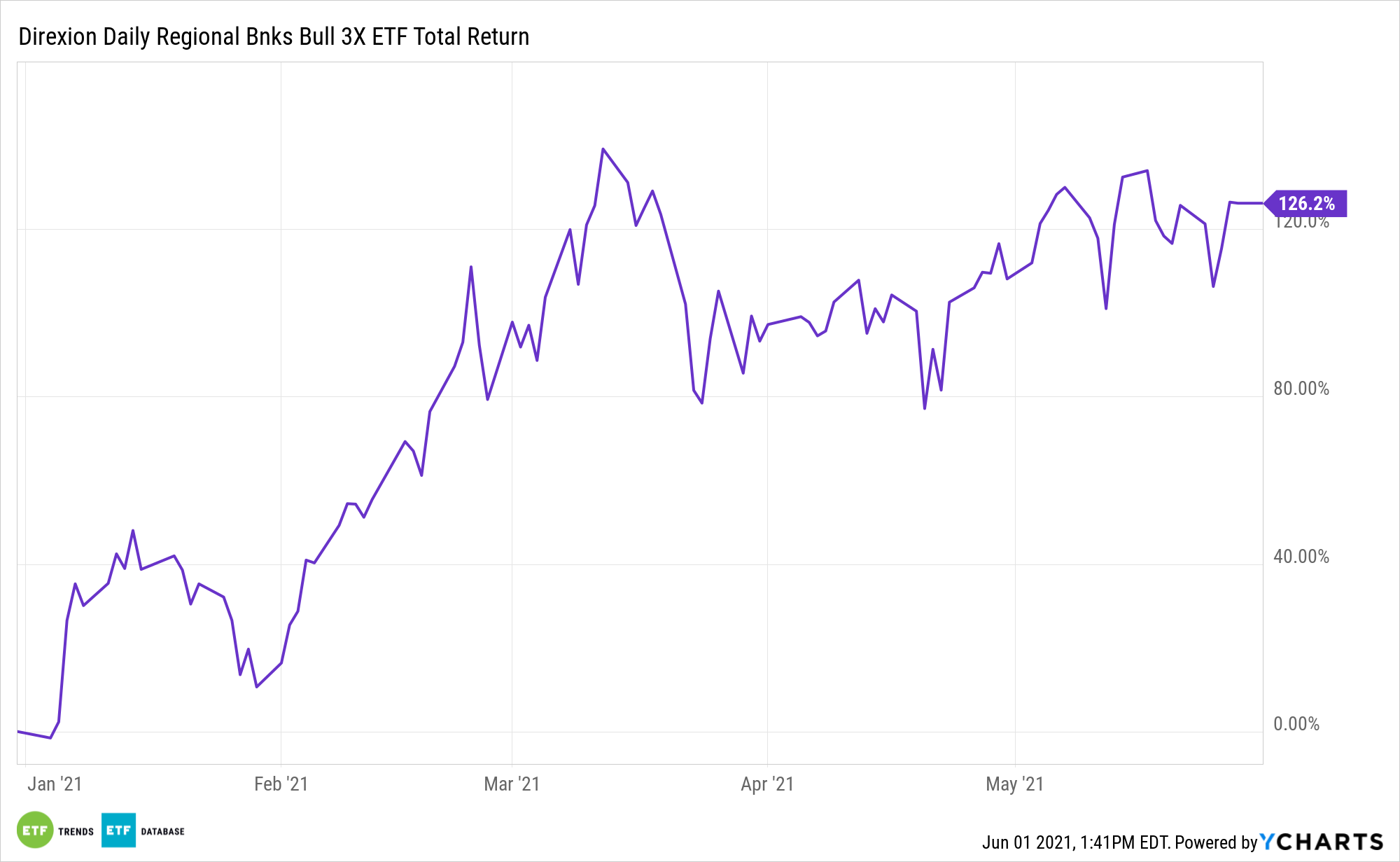

This Leveraged Regional Bank Etf Is Up Over 100 Ytd Nasdaq

Dpst Stock Price Today Plus 9 Insightful Charts Etfvest

Spdr S P Regional Banking Etf Cost Effective Relatively High Yielding Etf Nysearca Kre Seeking Alpha